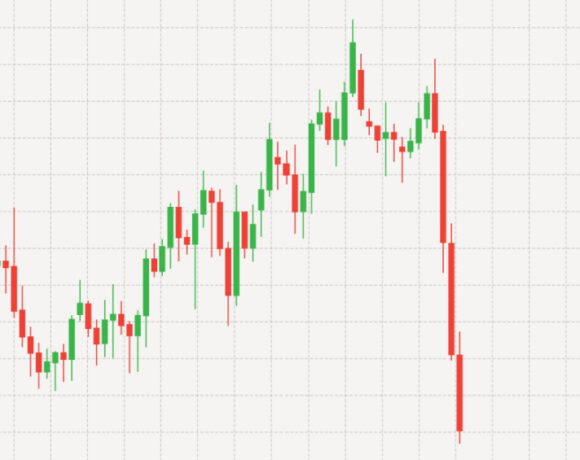

FinTech Index Plummets as “Busted IPOs” Take their Toll

Last year’s carnage on the Nasdaq, share price, tech stock, and IPO index was unbelievable. Data says it all in generic terms: With a decline of more than 51%, the Index had a dreadful, no good, let’s put it in the rearview mirror year. That was approximately in line with The Wall Street Journal’s 52% drop in the Global X FinTech ETF and substantially worse than the 33% Nasdaq drop, a comprehensive indicator of tech stocks. Because the shares in our Indices are weighted equally, and many have tiny market capitalizations, each penny of volatility fluctuation in a stock price, up or down, may have a massive influence.

And the data gets worse as you go deeper: Only two of the forty-five names we’ve watched have avoided becoming “busted IPOs,” where the shares have traded under their initial offering pricing. We’ll give them names straight away: Bill.com finished with a revenue of 109 dollars after the initial public offering happened at $22 in 2019. And Futu Holdings, for $38, is a far cry from its $12 initial public offering in 2019. The halcyon moments of 2019 and the outbreak of COVID-19 look long and far away for FinTech disruptors.

There are titles in our pantheon that will have dropped by more than 90% by 2022 – a group that nobody wanted to be a part of, but that included Affirm, Opendoor, and Upstart. MoneyLion fell beyond 82%. And the impact is not restricted to US companies or consumer-facing businesses. Triterras, which lost about 48% of its worth last week, is still being buffeted by business pronouncements that trade finance and credit insurance firms have been negatively impacted in a challenging macro environment.

Visit our website to read the recent fintech news, insightful analyses, and updates on fintech events.